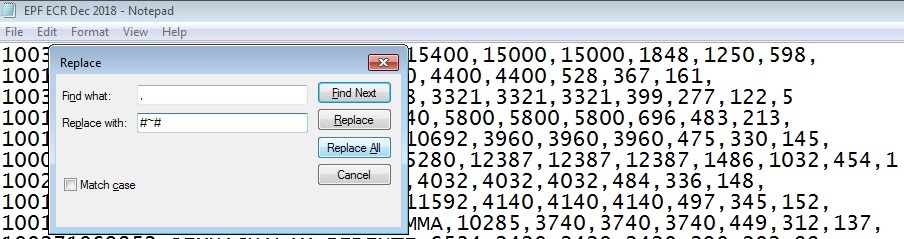

MY BANK IS HDFC.WHAT IS TO BE DONE. MY EMPLOYER BSNL A GOVT COMPANY IS NOT APPROVING BANK KYC.I TOOK VRS ON. Download the latest EPF ECR excel sheet format. Another main difference is the gross wages entry, in the old ECR format there is no need to add gross wages but in the new ECR file, we employer has to show the gross wages of employees also. Here is an example of NCP days in PF ECR excel file. The major differences in Old ECR format and the new UAN-based format are Universal Account Number, in the ECR text file 2 version UAN is mandatory in the old format we don’t need to add a UAN number. The latest ECR text file contains 11 fields, you can find the below to the table to know what details you need to enter in each field of ECR version 2.0 Excel. If is there any advance taken by the employee from the PF account, then he can repay that amount here. Noncontribution period days of employee i.e absenteeism days. 3/117, Door No : 5, Joy Complex, Muthu Nagar, Periyandipalayam,Tirupur - 641687. Furthed Updated see website : esipfconsultant. Generally it 3.67% of employer contribution towards PF, when the basic wage of an employee is greater than 15000 then it will automatically calculate the PF contribution of employer Dear All, Kindly find the attached file 100 working New ECR V 2.0.

The return will have member wise details of the wages and contributions including basic details for the new and exiting members (members who have joined or have left service in the wage month for which. This is an electronic monthly return to be uploaded by the employers through the Unified Porta l.

This is also new in the ECR file, here we have to add the gross wages of employees ECR stands for Electronic Challan cum Return. Here we have to put the UAN number of the employee

0 kommentar(er)

0 kommentar(er)